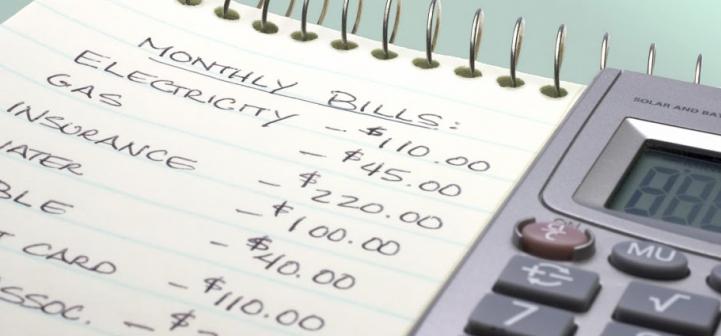

A spending plan is just exactly that, a plan for how you will spend all the dollars your earn and those given to you (including, hopefully, directing some to savings). To make a change in your spending plan such as adding in health insurance costs or taking on a new car payment, it helps to be as inclusive as possible when calculating all of your monthly expenses. In other words, don’t write in only the premium cost, but include some …

How are health insurance and car insurance similar and different?

Car (automobile) insurance is similar to health insurance in a very important way: both types of policies provide protection against financial losses.

Automobile and health insurance both help policyholders cover large costs that could financially devastate the individual or the family, like those experienced in unexpected car accidents or major medical procedures such as surgery, chemotherapy, expensive tests, or hospital stays.

Health insurance generally provides a wider range of benefits than car insurance. Car insurance, for example, will not pay …

Is there anyone who can help me determine my best health insurance option?

Each state will have consumer helpers available to assist individuals with health insurance decision-making. Find these helpers at Healthcare.gov the official site which provides accurate information to guide you through health insurance decision-making, and which also connects you to the Health Insurance Marketplace in your state.

Beware of commercial insurance industry professionals offering “free advice” or “assistance;” their efforts may be just a ploy to get you to buy their company’s policy regardless of other options that may meet …

Why is there a Health Insurance Marketplace?

The Patient Protection and Affordable Care Act mandates that each state must have an online health insurance “marketplace” or “exchange” to make comparing health insurance and purchasing a policy easier for you. This is not the only way to enroll. More information about getting help by phone or in person is available in the FAQ “Is there ayone who can help me determine my best health insurance option?”

The Health Insurance Marketplace will be open October 1, …

Are all pre-existing conditions allowed?

Yes, all pre-existing conditions are allowed and can no longer be used to bar an individual from obtaining health insurance coverage. This provision of health care reform and guarantee of coverage went into effect for children in 2010 and will apply to adults in 2014. Premiums will not be allowed to use pre-existing conditions as a factor for establishing rates.

The cost of coverage can be adjusted using only these four factors:

1) whether the policy covers an individual or …

Is a Health Savings Account (HSA) a good idea? What are the advantages and disadvantages?

Health Savings Accounts (HSAs) can be established if you have a high deductible policy. The policies may be offered by employers or purchased privately. Individuals open the account at a local financial institution that offers an HSA option. Funds deposited into the account may be made privately or with contributions from employers. The funds cover the out-of-pocket expenses you are expected to pay with your insurance plan and can include vision and dental expenses that are not covered …

Can I cancel my health insurance at any time if my premiums are deducted pre-tax?

Because your premiums are deducted pre-tax, this means that you purchase your health insurance through your employer and are responsible for paying a portion of the cost. Health insurance is canceled when you quit paying the premiums.

Assuming that you will be receiving health insurance from another source in the future, work with your employer’s human resources office (in a small company that might even be the person who handles payroll) to stop paying the health insurance premiums.

Make sure …

Does your health insurance premium go toward your deductible?

In most instances, the answer is no. Premiums and deductibles are two separate payments related to an insurance policy. A premium is paid to simply have insurance coverage in place regardless of whether or not a claim is ever made. A deductible is paid if there is a claim and is the amount paid out of pocket by the insured before insurance benefits are received.

We would like your feedback on this Personal Finance Frequently Asked Question.…