As you begin your estate plan and before you meet with attorneys and other financial advisers, it is helpful to assemble the following information. Having this information readily available will save you time and money in legal fees. It will also help you think through your wishes for distributing your estate. Use the Record of Important Papers, Household Inventory, and other forms in the Organize Your Important Papers lesson to assist you. Include in your list:

- Names, addresses, and birthdates of your spouse, children, and other loved ones whom you wish to include in your will; if applicable, list any disabilities or special needs

- Names, addresses, and phone numbers of possible executors, trustees, and guardians of young children

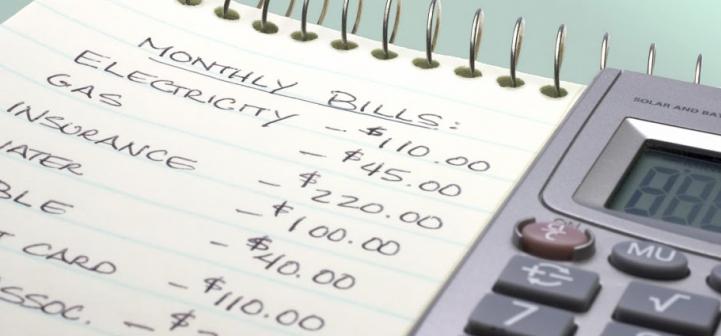

- Amounts and sources of income, including interest, dividends, and other household income

- Amounts and sources of debt, including business debt, mortgage(s), leases, and outstanding loans

- Amounts, sources, and beneficiaries of retirement benefits, such as pensions, Individual Retirement Accounts, Keogh accounts, government benefits, and profit-sharing plans

- Amounts, sources, account numbers, and other information related to financial assets, such as bank accounts, annuities, joint owners, and payable-on-death designees

- Life insurance policies, including issuer, owner, beneficiaries, account balances, and amounts borrowed against the policies

- Valuable property you own, its approximate value, and the names of the people to whom you wish to leave these items; include such property as real estate, furniture, jewelry, collections, and heirlooms

- Names of trustees, assets, and trusts held for your benefit

- Other documents that might affect your estate plan, such as divorce decrees, tax returns, pre-nuptial agreements, marriage certificates, wills, trusts, and property deeds

Lesson Contents

III. Power of Attorney: Planning for Incapacity

IV. Property Transfer: Documents and Legal Arrangements

VII. Personal Representative: To Carry Out Your Wishes

VIII. Gifting and Tax Strategies

X. How to Hire and Work with an Attorney

- a. Attorney Ratings

- b. Interviewing Prospective Attorney Candidates

- c. Deciding What to Include in Your Estate Plan

- d. Preparing a Checklist for Meeting with an Attorney

Prepare Your Estate Plan belongs to a series called Legally Secure Your Financial Future. The series also includes information to help you organize important household papers and to communicate your health-care wishes.