Are you looking forward to the day you retire? Or, do you dread the thought? Being able to retire when you want and how you want is important to many people. Planning ahead can put you in a position to live comfortably during your retirement.

The objective of this course is to help you with your planning for retirement. Each module provides information that can be valuable in answering the questions you need to consider as you make your plans. The modules include specific goals for the module, activities to complete, and sources for more information.

Introduction

This course has unique sections that lead you through the learning process and can be viewed sequentially or in a random order. To view a section, click on the down arrow in the navigation box located in the top left of the screen.

Progress through the section pages by clicking the next or previous navigation at the bottom of the screen.

For longer pages, use the navigation bar to the right of the text to scroll down to reveal the remainder of the information.

Before you begin, click on the Guide and print out the entire document. Use this Guide as you complete the modules.

Other Helpful tips:

All links for reference material will open a new browser window. Please close the window when you are done. “Planning for a Secure Retirement” site will always remain open.

Disclaimer: Mention of a trademark, proprietary product, or commercial firm in text or figure does not constitute an endorsement by the Cooperative Extension System and does not imply approval to the exclusion of other suitable products or firms.

Are You Ready to Retire?

Retirement Readiness Rating

The Retirement Readiness Rating is a series of questions to help you identify your financial personality.

According to the developers of the questions, your responses will help you to determine if you are:

- a planner

- a saver

- a struggler

- impulsive, or

- a denier.

You should allow about 20 minutes to answer the questions.

Retirement Personality Profiler

courtesy of the American Savings Education Council

Life Expectancy Calculators

When you start to plan for retirement, it is helpful to think about how long you will live.

There are several calculators that will help you to think about all of the factors that are involved, such as your health and how long your parents lived.

We suggest that you try at least two calculators to get a general idea of your longevity.

Click on these links for calculators:

courtesy of Northwestern Mutual Life

This game helps you to determine possible life expectancy by asking questions about lifestyle. You should allow 15 to 20 minutes to play the Longevity Game.

courtesy of MSN MoneyCentral

This calculator will also help you to determine your life expectancy. You should allow about 20 minutes to answer questions about your lifestyle.

Risk Tolerance

When you begin to plan for retirement, you will want to think about your level of risk tolerance when making investment decisions.

Are you conservative, aggressive, or somewhere in between?

These calculators will help you to determine what your risk tolerance is at present.

You might want to think about changing your preference to be more (or less) risky.

Click on any of the following links for calculators:

courtesy of Morningstar

You can compare your score to their rating.

courtesy of MSN MoneyCentral

This site asks you to complete 20 questions about risk, then it ranks your capacity for risk. You should allow 20 to 25 minutes for this test.

Follow-up:

Ask your spouse or partner to evaluate his or her risk tolerance, then discuss how you feel jointly about the level of risk you are comfortable with in saving for retirement.

Your Retirement Lifestyle

The amount of money you will need in your retirement years depends on the lifestyle you plan to lead. The following list of questions will help you decide what you really want in retirement.

Follow-up:

- Will you stay in your current home, move to a different location, or purchase a smaller home or a vacation home?

- Will you want to work for additional income? Will you want to start a new career?

- What do you want to do with your time? Hobbies? Travel? Recreation? Volunteer?

- What will you do for transportation? Use your own car or public transportation?

- How often will you eat out or entertain friends or family?

- How will your clothing and personal care needs change?

- What medical risks are you likely to face?

- What would you like to do if your health declines and you need help with daily living? Stay in your own home? Move in with children?

Click on the link below for more information:

“Honey, I’m Home!” – For Good: The Transition to Retirement

courtesy of the Department of Family and Consumer Sciences from The Ohio State University

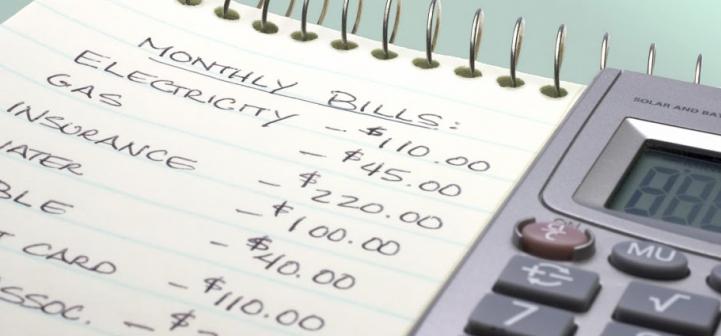

How Much Will Your Expenses Be in Retirement?

Retirement Living Expenses

It is important to think about what your expenses will be after retirement. A rule of thumb is that 70 percent to 80 percent of current income will be sufficient in retirement.

Retirees who plan to be very active may need the same amount of income in retirement that they presently earn.

Before you use the calculators, you will need to gather information about your current expenses.

Click on either or both of the following links for calculators:

courtesy of MSN MoneyCentral

This calculator will take about 15 minutes and will help you to focus on your expenses in the future.

courtesy of Principal Financial Group

Click on Managing Finances During Retirement. There are other calculators here that might be helpful.

When Can You Collect Social Security?

General Social Security Information

Many people will be eligible for Social Security retirement benefits. If you want general information about Social Security, you should begin on the Social Security Administration’s Web site.

Be sure to check the “Questions” section to see if any of your questions are answered there. Under “Publications,” you may view or download 110 of the benefit information publications.

Allow 30 minutes or more to explore this site.

courtesy of the Social Security Administration

Retirement Age

The age you choose to retire will determine the Social Security retirement benefits you receive. Check out the following sections of the Social Security Administration’s Web site to determine when you think you will retire and how it will affect your benefits:

You should allow about 15 minutes to examine this chart.

courtesy of the Social Security Administration

A chart will show your year of birth, full retirement age (years and months reflecting the changes), and the percentage that benefits are reduced for early retirement.

courtesy of the Social Security Administration

This link will provide information about delaying retirement.

Questions:

Based on information provided on the Social Security Administration’s Web site, answer the following questions:

1. When would David receive full retirement benefits based on his birth year of 1955?

2. How would his benefits be reduced if he retired early at age 62?

3. What would David’s benefits be if he waited until age 70 to retire?

Click on the next arrow to see the answers.

Retirement Age Answers

1. When would David receive full retirement benefits based on his birth year of 1955?

Answer – at age 66 and 2 months

2. How would his benefits be reduced if he retired early at age 62?

Answer – The monthly reduction would be .516 for a total of 25.80 percent.

3. What would David’s benefits be if he waited until age 70 to retire?

Answer – If he waits until age 70 to retire, he would receive an 8 percent yearly increase for each year that he delayed retirement.

Social Security Benefits Calculators

Social Security has a number of ways for you to estimate your Social Security benefits online.

You can use the Social Security Estimator to compute estimates of your future Social Security retirement benefits. The Social Security Estimator will give you estimates based on your actual Social Security earnings record. You can use the Estimator if you are not currently receiving benefits on your own Social Security record, not a Medicare beneficiary, you have enough Social Security credits at this time to qualify for Social Security, and you are NOT eligible for a pension based on work not covered by Social Security.

This estimator requires you to log in before it provides an estimate similar to the estimate that you receive in your Social Security Statement each year. You can also create “what if” scenarios using this estimator. Since this estimator links to your actual Social Security records, there are time limits for each page of the estimator to help keep your information secure. Go to Social Security Estimator if you are eligible to use the Social Security Estimator.

If you are not eligible to use the Social Security Estimator or don’t want to log in, you can use one of the other options for estimating your Social Security retirement benefits. There are 3 other options that are not linked to your Social Security record and which are based on your input:

- The Quick Calculator gives rough estimates of benefits at age 62, at full retirement age, and at 70.

- The Online Calculator gives benefit estimates based on past, present, and projected future earnings.

- The Detailed Calculator produces the most precise estimates and allows you to customize your projections for retirement, survivors, and disability benefits for yourself and your family based on differing scenarios.

Once you have an estimate you may want to link to additional charts and calculators provided on the Social Security web site to earnings, pensions, and different retirement dates can affect your benefits.

Go to Social Security Calculators to use one of the calculators.

Activity:

Try the Quick Calculator for David, who was born in 1955. His earnings for this year are $30,000. Now try the Quick Calculator using your age and earnings for this year.

Would You Like a Quick Estimate of Income Needed in Retirement?

Do You Have Other Sources of Retirement Income?

The purpose of this exercise is to help you understand what the sources of income are for current retirees and consider possible sources of future retirement income.

The Ballpark Estimate, developed by the American Savings Education Council, will help you estimate what your income will be in retirement. You will need to supply some information.

courtesy of the American Savings Education Council

What Are the Sources of Income for Current Retirees?

In the 2010 Retirement Confidence Survey 96% of retirees reported they receive income from social security. Forty-four percent said they receive income from an employer-sponsored retirement savings plan, such as a 401(k). Fifty percent receive income from personal savings and investments. Forty percent receive income from an individual retirement account (IRA), and 52% receive income from an employer-provided traditional pension or cash balance plan. In this survey, 23% of retirees reported working for pay at some time during their retirement.

To learn more, go to

courtesy of the Employee Benefit Research Institute

What Do Current Workers Say about Planning for Retirement?

- In 2010, 69% of all workers say they have saved for retirement. Older workers have saved more than younger workers.

- In 2010, 54% of workers report total saving and investments (not including the value of their primary residence or any defined benefit pension plans) of less than $25,000.Twenty-seven percent say they have less than $1000 in savings.

- In 2010, less than half of workers (46%) said they and/or their spouse have tried to calculate how much money they will need for a comfortable retirement.

- The majority of workers who report they have not saved any money for retirement (29% of workers and retirees) say it is because they cannot or could not afford to save.

courtesy of the Employee Benefit Research Institute.

What Can You Do to Increase Your Retirement Income?

1. Participate in employer pension plans when eligible.

2. Contribute as much as possible to a retirement plan at work. Your employer may provide a matching contribution, and it is important to contribute enough to receive the matching amount.

3. Establish an Individual Retirement Account (IRA) and contribute to it annually, if you are eligible.

4. Work part-time after retirement.

5. Save regularly by having an amount automatically withheld from your paycheck.

For more information about basic investing, go to

courtesy of Rutgers Cooperative Extension

Are You Eligible for Medicare and Other Health Benefits?

Determine Your Medicare Eligibility

Many people will be eligible for Medicare benefits. You may find general information about Medicare benefits on the official Medicare Web site. It includes a glossary, which explains Medicare terms.

On this site, you will be able to read many details about Medicare. You may want to begin with “Medicare Enrollment”, where you may get specific information about Medicare amounts and find answers to some common questions about Medicare.

courtesy of the U.S. Government

Compare Medigap Policies

The Medicare Web site also provides a comparison chart for Medigap insurance policies, which provide supplemental insurance for many health care services Medicare does not cover.

Using this chart, you will be able to find insurance companies that sell Medigap policies in your state, as well as information on plans they offer, how the plans are priced, and how to contact the insurance companies.

courtesy of the U.S. Government

Medicare Case Study

Question: An older adult says, I have learned about eligibility, Medicare Plan Choices, and Medigap plans, but I still have some other questions. How should I find answers to my questions about Medicare?

Response: On the Medicare web site, use Frequently Asked Questions.

Other Health Benefits

Some people may be eligible for health benefits provided by an employer or a union after their retirement. Be sure you understand the documents concerning your health care plan and have reviewed your summary plan description.

Ask your plan administrator to help you compare the costs and benefits of their plan with Medicare. Talk to your health plan administrator before you sign up for Medicare because you may not be able to get the benefits back from the employer or union.

courtesy of the U.S. Department of Labor

Do You Have a Retirement Plan that Your Employer Funds?

Eligibility

Many, but not all, employers have an employer-sponsored retired plan. Employer plans may be:

- Completely funded by the employer.

- Funded only by employee contributions.

- Funded by contributions from both the employer and employee.

Questions:

1. Does your employer have a retirement plan?

2. Is it funded completely by the employer, by employee contributions, or by employer and employee contributions?

3. Are you eligible to participate in the plan?

4. If you are a participant and must contribute, are you making the maximum contribution?

“Women and Retirement Savings” is an excellent resource located on the U.S. Department of Labor, Pension and Welfare Benefits Web site. It will take about 10 minutes to read.

For a general description of pension plans and retirement, go to Consumer Pension Plan Information from the Bureau of Labor Statistics

Defined Benefit

John works for an employer who has a “defined-benefit” pension plan. John may be eligible for a benefit based on the number of years worked, an average of his salary for the last three or five years, and a percentage that is stated in the plan.

In this type of plan, the number of years worked may need to be a certain number such as 10, 15, or 20, or there may need to be a combination of years worked and employee’s age. (Note: It is important to learn what the requirements are for your employer’s plan.)

Question:

John plans to retire next year after working for the employer for 30 years. His average income for the last five years was $45,000. John knows that his annual “benefit” will be 1.5 percent or 0.015 times the number of years worked times his average annual income during the last five years of employment. What will John’s benefit be?

Click the next button for the answer.

Defined Benefit Answer

Application:

John plans to retire next year after working for the employer for 30 years. His average income for the last 5 years was $45,000. John knows that his annual “benefit” will be 1.5% or 0.015 times the number of years worked times his average annual income during the last 5 years of employment. What will John’s benefit be?

Answer:

John’s annual benefit will be 0.015 * 30 * 45000 or $20,250.

Defined Contribution

Lisa works for an employer who has a 401(k) plan. This type of plan is the most well-known of all “defined-contribution” plans. The amount that an employee contributes each year is not subject to income tax, and earnings on the contributions grow tax-deferred until the employee retires and begins withdrawing from the account. When employees retire, the amount they withdraw is subject to income tax. Plans have regulations on eligibility and withdrawals.

Many employers match the contribution of an employee up to some limit. For example: an employer may contribute $0.50 for each $1.00 contributed by the employee, up to 6% of the employee’s salary.

Questions:

1. Lisa earns $25,000. Under her company’s 401(K) plan, she may contribute up to 10 percent of her salary, and the employer matches 50 cents for each dollar up to 6 percent of her salary. If Lisa contributes 6 percent of her salary, what amount of money will her employer contribute?

2. What amount must Lisa contribute to receive the employer’s match?

3. What additional amount could Lisa set aside? (Note: It will not be matched by the employer, but earnings will grow tax-deferred until retirement.)

Click the next button for the answer.

Defined Contribution Answers

Questions:

1. Lisa earns $25,000. Under her company’s 401(K) plan, she may contribute up to 10 percent of her salary, and the employer matches 50 cents for each dollar up to 6 percent of her salary. If Lisa contributes 6 percent of her salary, what amount of money will her employer contribute?

2. What amount must Lisa contribute to receive the employer’s match?

3. What additional amount could Lisa set aside? (Note: It will not be matched by the employer, but earnings will grow tax-deferred until retirement.)

Answers:

1. 0.06 * $25,000 * 0.5 = $750

2. 0.06 * 25,000 = $1,500

3. 0.04 * $25,000 = $1,000

Investment Decisions

Lisa has a 401(k) plan. The investment choices from her employer are similar to those of many other employers. Lisa’s employer offers a choice of seven mutual funds that range from low risk to high risk.

Question:

Who makes the decision about how Lisa’s savings are invested?

Click the next button for the answer.

If Lisa worked for a not-for-profit employer, it is possible that the employer would sponsor a 403(b) salary-reduction plan that is similar to a 401(k) plan. State and local government employees also may contribute to 457 plans that are similar to a 401(k) plan.

Follow-up:

1. Ask your employer what type of retirement plan is available.

2. Find out if you are eligible to participate.

Matching Contributions Answer

Question:

Who makes the decision about how Lisa’s savings are invested?

Answer:

Lisa. She will be able to choose from the investments selected by the employer. A typical plan has seven or eight choices. These usually consist of mutual funds ranging from low risk to more risk.

Profit-Sharing Plans

There are three basic approaches to funding profit-sharing plans. They are:

- 1. current (cash)—profits are paid directly to employees in cash, check, or stock as soon as profits are determined.

- 2. deferred—profits are credited to employee accounts to be paid at retirement or upon other stated circumstances such as disability, death, severance, etc.

- 3. combined—part of the profit is paid out currently in cash and part is deferred.

Employer contributions to profit sharing plans may be made on a discretionary basis (as determined annually by the board of directors) or in accordance with a definite predetermined formula.

Questions:

David’s employer has a profit-sharing plan.

1. How will David know how much his plan will “grow” each year?

2. Will David have enough money for retirement?

Click the next button for the answer.

Profit-Sharing Answer

Questions:

David’s employer has a profit sharing plan.

1. How will David know how much his plan will “grow” each year?

2. Will David have enough money for retirement?

Answers:

1. The amount will vary depending on the following:

- a. The amount of employer contributions that might be zero for some years.

- b. Earnings on the investments.

2. Maybe. The employer does not have to contribute every year so David should have other retirement savings.

Are You Self-Employed and Responsible for Your Own Retirement?

Simple Retirement Solutions

Many people choose to have their own business. They have several options for retirement plans. A good place to start is “Choosing a Retirement Solution for Your Small Business” on the U.S. Department of Labor Web site. This section is 4 pages long and will take less than 10 minutes to read.

Follow-up:

Make a list of retirement plans that would work for you if you are self-employed or a small business owner.

Simplified Employee Pensions

Another section of the U.S. Department of Labor focuses only on Simplified Employee Pensions (SEPs). It includes specific information about who is eligible to participate in the plans and has answers to commonly asked questions. It will take about 15 minutes to read.

courtesy of the U.S. Department of Labor

Follow-up:

1. List one or two reasons why an SEP would work for you.

2. List one or two reasons why an SEP would not work for you.

SIMPLE Plans

Another section of the U.S. Department of Labor Web site focuses only on Savings Incentive Match Plans for Employees of Small Employers (SIMPLE) plans. Allow 15 to 20 minutes to read this resource.

courtesy of the U.S. Department of Labor

Follow-up:

1. List one or two reasons why a SIMPLE would work for you.

2. List one or two reasons why a SIMPLE would not work for you.

Comparison Chart

Retirement plans for small business owners fall into two categories:

- 1. Lower cost, less administration

- 2. Higher cost, more administration

SmartMoney.com provides a chart that compares SEP-IRAs, Keogh plans, SIMPLE-IRAs, and 401(k)s in an effort to help business owners decide which type of plan best suits them. The chart will take about 15 minutes to read.

courtesy of SmartMoney.com

Follow-up:

1. Would one of these plans be appropriate for your needs if you are self-employed?

2. If none of these plans are appropriate for your needs, have you considered an Individual Retirement Account? If you want to learn more about an IRA, go to the section titled “Do You Have an Individual Retirement Account?”.

Do You Have an Individual Retirement Account?

The Basics

Individuals have the option of investing in tax-deferred financial products as a way to save for retirement. These products include traditional Individual Retirement Accounts (IRAs) and Roth IRAs.

The guides listed below provide the basics about IRAs and explain how to establish an IRA. You should allow about 20 minutes to become familiar with these guides.

courtesy of 360 Degrees of Financial Literacy

courtesy of the Internal Revenue Service

Basic Examples

Read the fact sheet on Understanding IRAs provided by 360 Degrees of Financial Literacy to determine answers to the following exercise:

Questions:

1. Abby, age 25, is single and has no retirement plan at work. She has an adjusted gross income of $39,000. Is Abby eligible for a tax-deductible IRA?

2. Mike, 37, is self-employed and has no retirement plan. Sandy, 38, works for a publishing company and has a defined-benefit plan. Mike and Sandy’s adjusted gross income is $62,000. Would Mike be eligible for a tax-deductible traditional IRA?

Follow-up:

See “Publication 590” under How Much Can I Deduct? Table 1-3 or Table 1-2 to determine if you are eligible for a tax deductible traditional IRA.

Click the next button to view the answers.

Basic Examples – Answers

1. Abby, age 25, is single and has no retirement plan at work. She has an adjusted gross income of $39,000. Is Abby eligible for a tax-deductible IRA?

Answer: Abby is eligible for a tax-deductible traditional IRA.

2. Mike, 37, is self-employed and has no retirement plan. Sandy, 38, works for a publishing company and has a defined-benefit plan. Mike and Sandy’s adjusted gross income is $62,000. Would Mike be eligible for a tax-deductible traditional IRA?

Answer: Mike is eligible for a tax-deductible traditional IRA because his and Sandy’s joint income is less than $150,000.

Traditional IRA or Roth IRA?

One decision individuals have to make is whether to use a traditional or a Roth IRA. Your situation will influence which type is most appropriate for you.

Many investment firms offer IRA calculators to assist with this decision. These calculators provide general estimates that can be helpful in seeking further assistance with setting up a traditional IRA or Roth IRA.

In order to complete the forms for the calculators you will need some specific information. Each calculator asks for different information. You will need to know:

- your tax return filing status

- if you currently participate in an employer-sponsored retirement plan

- if your spouse currently participates in an employer-sponsored retirement plan

- your federal income tax rate

- state tax rate

- adjusted gross income

- years to contribute to an IRA

- amount you expect to contribute to an IRA annually

- number of years you will draw on an IRA

- rate of return you expect from your IRA

Here’s a brief summary that compares traditional and Roth IRAs:Comparison of Traditional IRAs and Roth IRAs The chart was developed by the American Institute of Public Accountants on 360 Degrees of Financial Literacy.

Click on any of the following links for calculators to analyze the types of IRAs:

courtesy of State Farm Insurance

courtesy of Morningstar

Traditional or Roth – Which is Best?

Questions:

1. Abby, age 25, is single and has no retirement plan at work. She has an adjusted gross income of $39,000. Abby wants to retire when she is 67 and begin using the funds in her IRA. She expects to make withdrawals until she is 87. She is in the 28 percent tax bracket and expects she will be in the 15 percent tax bracket during retirement. She would like an 8 percent rate of return on her investments. She plans to contribute $4,000 each year. Which IRA makes the most sense for her?

2. Mike, 37, is self-employed and has no retirement plan. Sandy, 38, works for a publishing company and has a defined-benefit plan. Their adjusted gross income is $62,000. Mike and Sandy want to retire when they are 62 and begin withdrawing from their IRA. They expect to live to age 85, and they would like to earn 9 percent on their investments. Which IRAs make the most sense for them?

Use these IRA calculators to make comparisons and help determine the answers in the questions 1 and 2.

courtesy of State Farm Insurance

courtesy of Morningstar

Once you have made your comparisons and determined an answer, click the next button to view the answers.

Answers to questions

1. Abigail used several calculators on the Internet and learned that she would have more income in retirement if she contributed to a Roth IRA instead of a traditional IRA.

2. Mike and Sandy used several calculators on the Internet. They decided that the Roth IRA would be more beneficial for Mike.

Funding an IRA

Once you have determined that you want to fund an IRA, you have many options. For general information about funding an IRA, visit the Kiplinger Web site. It will take about 10 minutes to read this information.

courtesy of the Kiplinger Washington Editors Inc.

If you want more information about basic investing, see Investing for Your Future.

courtesy of Rutgers Cooperative Extension

What is a Lump Sum Retirement Distribution?

Lump Sum Distribution

To be considered a “lump sum distribution” for tax purposes, money must come from an Internal Revenue Service (IRS) qualified retirement plan. Some examples would be a 401(k) plan, profit-sharing plan, or another approved pension plan.

A lump sum must be payable due to separation from service, death, disability, or after you have reached age 59 ½. In simpler terms, you could be eligible to receive a lump sum distribution in the event of a job change, layoff, or retirement. You must receive the entire amount within one tax year.

What Should You Do with Your Lump Sum?

If you receive a lump sum distribution, you can choose between four options:

1. Take the money and pay the taxes.

2. Take the lump sum and use tax averaging.

3. Deposit the money into an IRA, other qualified retirement plan, or a new employer’s plan. This is called a “rollover.”

4. Leave the money in your current employer’s plan.

courtesy of the Internal Revenue Service

courtesy of Smart Money

Early Termination

A participant who terminates employment before normal retirement age can have up to three options: receive a lump-sum distribution, roll the assets over to an IRA or other qualified plan, or leave the funds in the pension plan.

If the participant’s vested account balance is less than $5,000, the law allows, but does not require, the plan to disperse the balance to the participant if the participant does not make a timely election. This is called a forced payout.

If the amount is between $1,000 and $5,000, the payout can be directly rolled to an IRA if the participant has not made a timely election and the plan requires a forced payout. A forced payout for an amount less than $1,000 is not affected by this change.

Starting a New Job

Lynn, 30, is leaving her current job and starting a new job. She has a lump sum distribution of $3,500. She would like to plan for retirement, but she would also like to pay some bills, take a vacation, and get a new wardrobe. She is currently earning about 9 percent on the lump sum. She doesn’t know when she will retire, but thinks that age 67 is about right.

Lynn could roll over the lump sum distribution into an IRA and the amount would continue to earn interest until she retires. Using a financial calculator, Lynn estimates that the $3,500 could grow to $60,359 after 37 years if it earned 8 percent interest compounded annually.

This is a helpful financial calculator.

courtesy of Moneychimp

If Lynn takes the lump sum distribution in cash, there will be a 10 percent penalty (because she is younger than 59 ½) and she will owe regular income taxes on the amount withdrawn. Lynn needs to decide between having a small amount now or waiting until she retires.

Getting Ready to Retire

Al, 62, has the possibility of a large lump sum distribution from his employer. Because he is retiring and is older than 59 ½, there is no penalty tax associated with the withdrawal.

He plans to roll the money over into an IRA and establish “substantially equal periodic payments” over his life expectancy or over the joint life expectancy of himself and a beneficiary.

A caution:

Al must be careful to roll over the lump sum into an IRA within 60 days of receiving it. The employer can do a direct rollover from the employer plan to the IRA, and Al will not receive the lump sum in the interim.

If Al takes receipt of the lump sum, the employer must withhold 20 percent from the total for taxes.

If Al takes the lump sum but makes the rollover into the IRA within the 60-day limit, he will eventually receive a refund of the 20 percent withholding tax.

There are additional regulations that might apply, but these illustrations should help you decide what to do with a lump sum distribution. Be sure to discuss the proposed distribution with your plan sponsor before making a commitment.

Do You Have Other Concerns?

Enjoying Retirement

In addition to thinking about your financial needs during retirement, you may have other concerns related to retirement living. Leisure time use is often different for retirees than for non-retirees. You may be thinking of moving to a different home or location for your retirement years.

Below you will find information about enjoying retirement living. It will take about 10 minutes to read.

courtesy of Met Life

The federal government’s Access America for Seniors Web site links you to information about employment and volunteer activities, travel and leisure, education and training, as well as health and nutrition information. The time you spend on this site will depend on your interests.

courtesy of the U.S. Government

Retirement Housing

For questions about housing during your retirement years, review information on the U.S. Department of Housing and Urban Development maintains the following web site :

courtesy of the U.S. Department of Housing and Urban Development

Information from West Virginia Extensin also addresses factors to consider regarding housing during retirement. This publication “Relocation-Housing Alternatives for Later Years” includes questions for you to consider.

courtesy of the West Virginia Extension

Another site that includes a variety of information related to retirement living is maintained by the American Association of Retired Persons. You may view information on volunteering, health and wellness, leisure and fun, and other related topics. The time you spend here will also depend on the topics that interest you.

courtesy of the American Association of Retired Persons

Estate Planning

Many people also make estate planning decisions at the same time they make retirement planning decisions. Some questions to ponder include:

1. What do you want done with your property after your death?

2. Do you know the advantages and disadvantages of living trusts?

3. Do you have a living will, health care representative, or durable power of attorney?

Purdue University offers a web site that provides good basic information along with a helpful checklist you may complete and use with an attorney. You will need to check the state laws where you reside for specific estate planning information. The web site introduces basics concepts, tools you can use, and questions you need to consider.

courtesy of Purdue University

Long-Term Care Insurance

Long-term care insurance protects you against the significant financial risk posed by the potential need for long-term care services, either in a nursing home, assisted-living facility or in your own home. Many people make decisions about long-term care insurance at the same time they are thinking about retirement planning.

Here is some general information on long-term care insurance:

courtesy of National Cleraninghouse for Long-Term Care Information

courtesy of the AHIP

Financing Long Term Care: A Resource Center for Families, prepared by the University of Minnesota Extension Service, provides more information about long term care as a family financial issue.

courtesy of the University of Minnesota Extension Service

BenefitsCheckUp

BenefitsCheckUp is a free service that identifies federal and state assistance programs for older Americans. The National Council on Aging created it to help people quickly identify programs that they may qualify for and how to apply for them. Family and friends can use BenefitsCheckUp to get facts about programs for loved ones.

You will need to enter information such as your age, income and zip code so BenefitsCheckUp can identify programs. Your information is confidential.

courtesy of the National Council on Aging

eXtension offers its Personal Finance Web site to help consumers gain skills, confidence, and motivation to build financial security for themselves and their families. It includes online tools for later life financial planning.

courtesy of eXtension Personal Finance

Help

Helpful Hints

1. All links for reference material will open a new browser window. Please close the window when you are done. “Planning for a Secure Retirement” site will always remain open.

2. Disclaimer: Mention of a trademark, proprietary product, or commercial firm in text or figure does not constitute an endorsement by the Cooperative Extension System and does not imply approval to the exclusion of other suitable products or firms.

Credits

Content Development by

Sharon DeVaney, Professor, and Janet Bechman, Extension Specialist

Spanish Translation by

Alicia Rodriguez

Funding by

Extension Initiative Grant

Web Development by

Agriculture Information Technology, Purdue University

Web Graphics by

Agriculture Communication, Purdue University